The Key to Wealth

Peri Scott - November 18, 2019

I have been a professional musician for over thirty years. At my best, I was able to play just about anything without really trying very hard. It seemed magical to those who didn’t play an instrument or were less proficient than me. I could hear a song just once and I was able to play it perfectly. I didn’t need to practice very much because I was playing so often I had no need to do scales or figure out fingerings, it just happened. This level of proficiency took many, many years of practice and performing to attain and I was very respected for my level of ability.

Humbled

I thought I was a “pretty big deal” until I decided I would supplement my income by teaching piano lessons to kids.

There is no more eye-opening exercise than to explain concepts to a complete beginner that you have taken for granted for decades. Trying to explain it in terms that they will understand is very hard and I often had to use metaphors and stories to get my point across. I had to really take a step back and re-examine the super simple, basic fundamental building blocks of music and try to explain them.

In doing this, I realized that:

I didn’t even realize that some of the concepts I took for granted are NOT common sense.

In trying to deconstruct the roots of music theory I actually had to rebuild my own foundation

I discovered I had some gaps in my own understanding of the fundamentals that I discovered by being asked mundane questions about them.

This was amazing! My musical ability actually went to a whole new level after I went back to the basics because I had never truly appreciated the depth and breadth of the simple mathematics of rhythm and harmony and how to put it all together. My mind was blown and I understood that all the most advanced and complicated musical ideas and themes were built upon a solid foundation and could not exist without it.

I thought this blog was about money?

I mention this because I recently developed a training course that explains in a step-by-step format my investing strategies and I realized while creating it that everything I was talking about depended upon ONE very simple, fundamental concept. It is so simple, yet so powerful and profound that I dedicated a whole lesson to it.

This concept is similar to the explanation of golf:

“Hit the ball into the hole.”

This is very simple, yet is extremely hard to do.

Spend Less Than You Earn

The basic concept has been talked about and written about and pounded into our heads since they invented barter yet it seems to be an extremely difficult thing to do for most people.

I think I am going to make this my financial mantra. It is so basic and easy to understand that people disregard it and want to move on to the cool stuff.

Yet it is so difficult to do. Most people don’t even do this one, simple step and they somehow believe that magically things are going to work out in the end. They believe that through some kind of witchcraft that they can beat the system and do some fancy investing strategy and become financially free without paying much attention to this “ basic” stuff.

This basic stuff is truly the foundation of ALL wealth. I can’t seem to find the appropriate words to emphasise just how fundamental and necessary and all important this concept it. It is likened to a cornerstone of a building. All buildings need a solid foundation upon which to rest, or else they will eventually bend, crack and fall over. I don’t care how cool of a design they are, they cannot stand on nothing. The very cool and effective investing ideas and strategies I explain in my books and courses can ONLY work if you follow this basic rule. There is no other way.

I have read thousands of books in my lifetime and hundreds on personal finance, investing and wealth creations (read my top 5 here). They all have amazing ideas and if you follow the plan, you can achieve great things. Without exception, all the strategies require you to spend less than you earn.

This is lesson 1.

This is day one.

This is the golden rule. Do not pass “Go”, do not collect $200. You cannot move forward unless you embrace this concept and live by it. You must adhere to this principle with all of your might. It will get you through just about anything.

“Pay yourself first.”

“Spend less than you earn, then invest the difference. “

These phrases have been beaten to death in personal finance circles for decades. Why?

BECAUSE THEY ARE POWERFUL.

Why am I belabouring this?

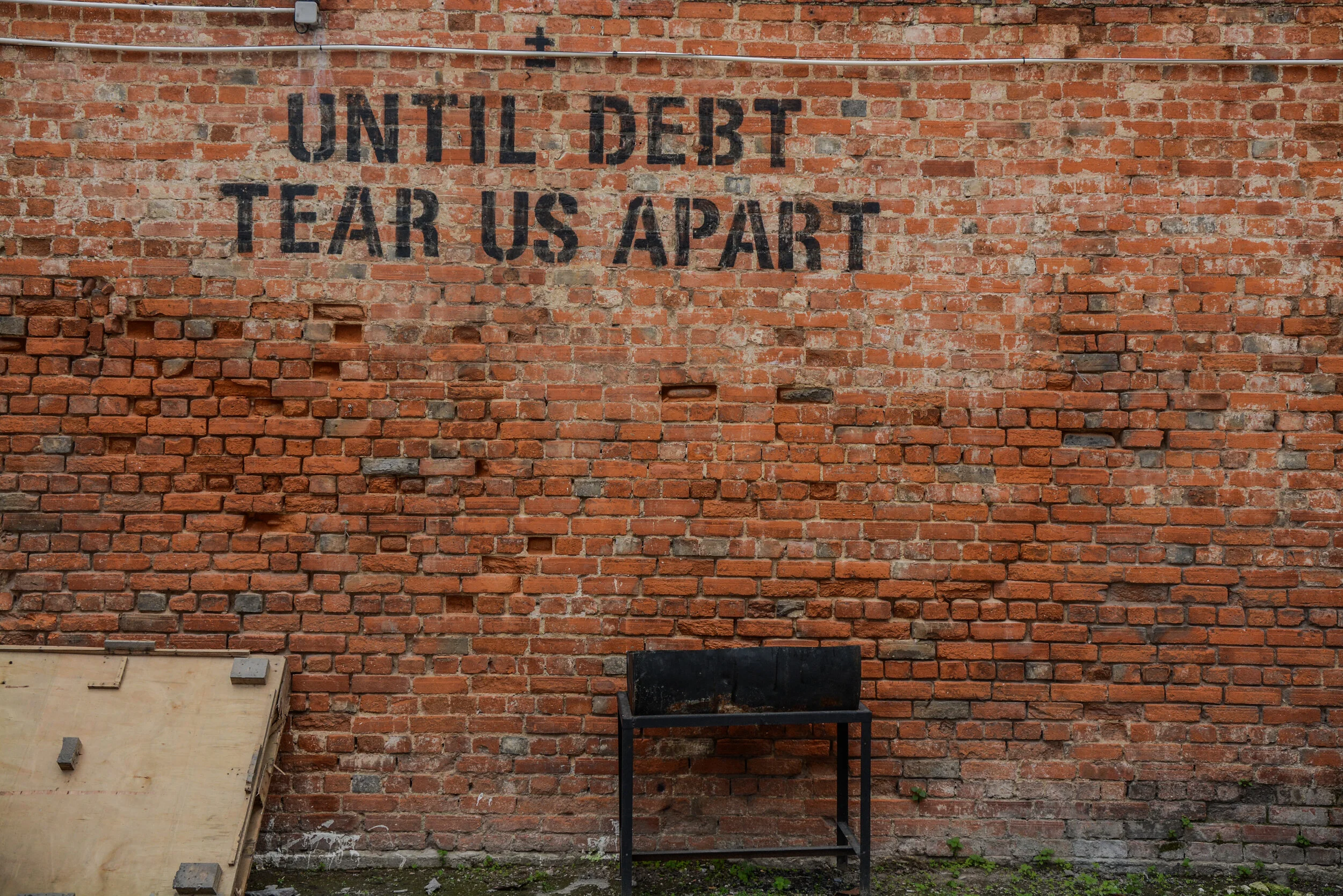

Credit Card debt in the US alone is over 1.2 TRILLION dollars. I am not convinced people are embracing the concept of “spend less than you earn” in their everyday lives.

We live in a society that encourages you to “Spend! Spend! Spend!” Keep up with the Jones’s! Get that latest smartphone! Visit this tropical paradise! Buy this massive house! We will approve you! You can “look” like you have arrived..or are on your way.

We are bombarded by consumerism and we believe that “things” will make us happy. Studies have shown that the opposite is true. We get a quick “high” when we buy something but that initial happiness we feel quickly fades. There is a diminishing return. In contrast, experiences actually go “up” in value over time. Those same studies demonstrate that we tend to idealise and positively distort our perceptions and memories of events over time, giving them more “value” over time. The interesting thing about “events” that we remember positively is that there is no correlation between the happiness it brought us and how much it cost. We are far better off having good times with the people we care about than buying a new big screen TV.

Delayed Gratification

We are addicted to instant gratification. Our brains are wired to seek out anything that will make us feel good. We are either seeking pleasure or avoiding pain. Our ancient ancestors were experts in the “avoiding pain” category as they lived in a much more dangerous world and pretty much getting through the day without being eaten or starving to death was a good day. Seeking pleasure was a relatively infrequent activity so our brains have evolved to be vigilant to any threats to our relative safety.

Dopamine is the “Feel Good” chemical in our brain that is released whenever we experience pleasurable activities. It had played an important part in our evolutionary progress as it most likely was part of our motivation to propagate the species - among other things. This mechanism is useful, but like any bodily function it can become impaired from overuse. IF we get “too much of a good thing”, we can severely desensitise our dopamine receptors. It takes more and more stimulation to create a feeling of joy and pleasure.

Social media propagates this problem. Every time we get a “like” or someone comments on our bathroom selfie we get a little “hit” of dopamine, like a drug addict. We need everything “right now!” We don’t have to wait for food. We don’t have to wait for information. We can get most of our needs and desires met almost instantly these days. The problem here is that it tricks us into believing that EVERYTHING we want or desire should be instant. We make the mistake of believing that even the big, important or worthwhile achievements that we are pursuing in life shouldn’t take very long. The truth is, most worthwhile achievements take time.

We want to live the lifestyles that we see on TV and Snapchat. We believe that being rich or famous is the only way that we can be worthwhile. The media never make a big deal out of people that work hard for twenty or thirty years to create a business or invest over a long period of time to achieve their wealthy lifestyle. They never mention the people that live in a modest house and drive a modest car and wear modest clothes, choosing instead to invest their time in friends, family and commit time to self improvement. They take no notice of people who appear average in everyday life, yet are millionaires. Sorry, that is just not good TV, so they focus on the overnight success, the lottery winner, the 20 year old internet billionaire or the celebrity. They celebrate professional athletes and rappers. This is entertainment, not reality.

I have no problem with entertainment, as long a people realize that it is on TV for a reason - it is not real. It is larger than life so it is TV worthy, but it is NOT reality. People forget that real life happens all around us and that TV does not necessarily reflect the real world that the rest of us live in.

I wrote an article about how most rich people achieved their wealth through very mundane ways. The underlying theme common to most of these boring stories is a tag line of “spend less than you earn”

These people created wealth through principles such as hard work, delayed gratification, Self-disciple, and long term perspective. There is not much TV worthy material there, yet is really the most realistic way a regular person will ever get wealthy.

Real wealth is possible to just about anybody who lives in a free country and has access to opportunities. It requires a huge, steaming helping of BORING to get there. You need to forgo the new smartphone. You need to pay special attention to your housing costs, your transportation costs and your budget. You need to have the self-discipline to NOT try to impress your friends and bring that bagged lunch to work. It requires waiting until you can afford it. It requires you to look at the long term.

Long Term Perspective

There was a study done many years ago that tracked Harvard students over many years after their graduation to see what factors would influence their relative success in life. They looked at intelligence, work ethic, connections, family background, attractiveness, and a myriad of other tangible and psychological factors. In the end, they could only find one commonality amongst the highest achievers. You guessed it - Long Term Perspective. These people tended to make decisions that had an impact on their long term goals. They focused their daily activities on their future plans and developed habits that would benefit them over time. Daily habits are the key to success. Small incremental improvements, building on the day before eventually lead to success. Big, grandiose gestures will rarely lead to long term anything. Success is boring. At least, the path to success is dull. It requires you to invest your time, not spend it. It requires you to make choices that will benefit “future” you, not “present” you.

People tend to be a little disappointed when they figure out that becoming wealthy tends to be a long process. It isn’t as exciting as winning the lottery or inventing Facebook. Some even feel that making something that is a fantasy into something actually doable and real kind of takes the fun out of it. Maybe. Being wealthy isn’t for everybody and it certainly doesn’t guarantee that you will be happy. Money doesn’t solve every problem but it sure makes navigating our capitalist society a bit easier. Life costs money, and it seems like it would be a lot easier to be the best version of yourself if you had time and freedom to pay attention to other things than paying the bills.

Self Discipline

The primary attribute you need to develop within yourself in order to spend less than you earn on a consistent basis is self discipline. You will never be able to stick to the prime directive if you are always giving in to your immediate desires. Self discipline allows you to delay gratification and to do the tough mental work of figuring out what makes the most sense for you from a long term perspective. Spending less than you earn becomes a habit and a lifestyle, but also a key factor in your decision making criteria. As you flex your self discipline muscles you will get better at automatically making decisions that benefit you in the long term. You will start to learn ways of making your money go farther. You will start to seek out new opportunities to learn and grow.

You will realize that investing in yourself is necessary if you want to really be successful. Instead of watching TV and spending hours mindlessly scrolling through social media feeds for a short-term dopamine hit, you will read books, take courses, and seek out people and mentors who can teach you new things.

You will use self discipline to take care of your body so that you have the energy and vitality to pursue your goals. A clear mind and a healthy body will improve your mood, sustain your work ethic and perhaps make you more attractive, which never seems to hurt in your interaction with other people.

Some philosophies suggest that the universe is always striving for balance. It will always try to dole out pleasure and pain in equal measure to its participants. If you have too much of one or the other, something usually happens to bring things back to balance. I am not sure that this is true or not, but it seems interesting to me that people who choose their own pain ie. stressing their muscles at the gym, tend to experience less involuntary pain. As I mentioned before, most things that are important and worthwhile take time and are hard to do. That “hard” is painful. It requires effort and self discipline which in considered suffering to the universe, albeit voluntary, therefore it goes into the pain side of the ledger - prompting something pleasurable or good to “happen” in order to keep the balance.

Really, most self discipline is just choosing to pay the price for the things you want. Nothing worthwhile is free, everything has a price. If you are willing to pay the price you can have anything you want. This is a simple rule, like our mantra - Spend less than you earn.

The deceptive thing about a simple concept like “Spend less than your earn” is just how powerful it really is. Even following this rule and never doing anything else, you will end up wealthy. It is basic math. You cannot avoid it. I find that amazing. Yet, most people are so enticed into breaking this rule by a world full of distractions and pleasure-seeking that they never get the chance to feel the immense impact this can have on their lives and their true long term happiness.

A journey of a thousand miles beings with one step. - Old Chinese Saying

Take the step. It is a simple step, but not an easy one. It has the potential to change your whole life. You might open up a whole world of new and exciting possibilities by beginning your journey with a commitment to yourself and to the new golden rule. Make this the foundation of your financial life:

Spend less than you earn.

There is a difference between earning money and managing money, and it’s massively important to understand it.